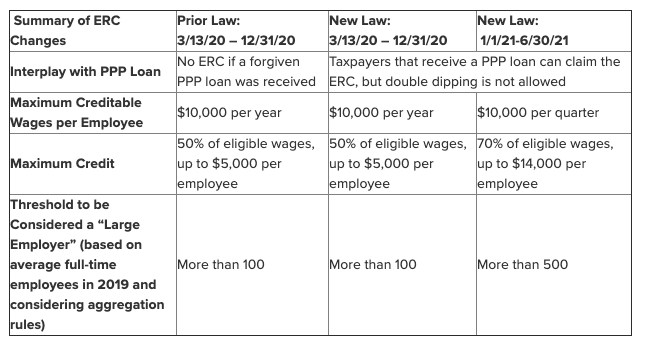

Employers with less than 100 employees are not limited in that way for this credit in 2020. While employers with more than 100 employees can claim the ERTC for 2020, qualified wages will only include wages paid to employees if they were paid to not work. In 2020, the credit is for 50% of up to $10,000 in qualified wages for the year, per employee. The qualifications outlined by the CARES Act in 2020 allow eligibility based on a significant decline in gross receipts, defined as at least a 50% decline in gross receipts compared to the same quarter of 2019. If there is a significant decline in gross receipts, as discussed below.There were situations, however, where credit union branches housed within a business that had to be closed, such as a school or shopping center, could qualify under this scenario. For example, even if lobbies were closed or had reduced hours, the drive-up facilities remained open, which made it difficult to qualify under this condition. Most financial institutions were considered essential businesses and remained open during the pandemic. If operations are fully or partially suspended by an appropriate government authority limiting commerce due to COVID-19.

There are two scenarios in which a credit union can qualify as an eligible employer: Understanding the basics of the ERTC can help you determine whether your credit union may be eligible and can help you determine if the recommended claim amount appears reasonable. Because the rules related to the ERTC are complex and have significant tax-related implications, most credit unions should seek assistance with this process, and it’s important to use caution in choosing a partner to assist with filing an ERTC claim.ĭo you qualify for the employee retention credit? You may have recently been contacted by an unknown organization claiming your credit union qualifies for a substantial ERTC claim. The millions of dollars available through the Employee Retention Tax Credit (ERTC) have sparked a multitude of organizations seeking to capitalize by assisting potentially qualified credit unions with claims.

0 kommentar(er)

0 kommentar(er)